Once you’ve submitted your tax return you’ll know how much you owe HMRC. But how and when do you need to pay? We’ll talk you through Payment on Account and the deadlines.

When to pay your Self-Assessment Tax

Self-assessment Payment on Account applies to UK taxpayers where less than 80% of your income has tax deducted ‘at source’. That means your tax is paid before you receive the money, such when an employer pays an employee under the Pay As You Earn (PAYE) system.

What is Payment on Account?

Payment on Account is the UK system for settling tax the tax owed. The payment is spread over two instalments during the year, based on the previous year’s tax bill.

Essentially, you make an advance tax payment to make sure you never fall behind and end up in debt to HMRC. If your tax liability ends up being higher than the previous year, you may need to make a further payment to keep your tax in balance.

When do I have to pay my tax bill?

If you use Payment on Account, the first payment date is midnight on 31 January. Because this is prior to the end of the tax year, it’s calculated by looking at your previous year’s tax bill.

The deadline for the second instalment is midnight on 31 July, after the end of the tax year in question.

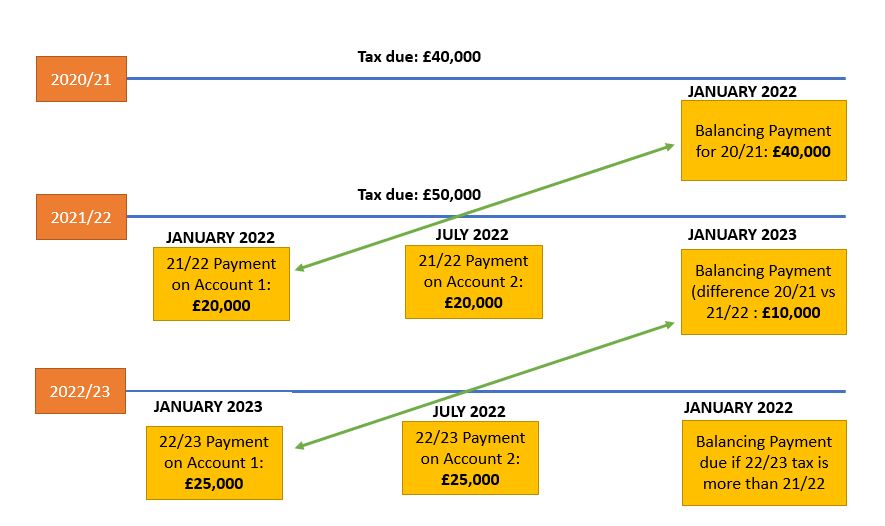

Each instalment is usually 50% of your previous tax bill. Here’s an example:

| Tax Bill for year ending April 2021 | £40,000 |

| Payment due on 31 Jan 2022 | £20,000 |

| Payment due 31 Jul 2022 | £20,000 |

But what happens if you need to make a balancing payment?

Using the example above, let’s say your total tax owed for the 2021/22 tax year comes in at £50,000. That means you have an outstanding balance of £10,000 (£50,000 owed minus the £40,000 paid by 31 July). This is called the balancing payment. It has to be settled by 31 January 2023.

So your 2022/23 payment plan would work as follows.

The main thing to note here is that each January you need to schedule in two fairly large tax payments – the balancing payment from the previous tax year AND the first Payment on Account for the current tax year.

Exceptions to the rule

There are some situations where you won’t have to make two Payments on Account in a tax year. These include:

- Where you’ve already paid 80% or more of the total amount of tax you owe

- Your self-assessment tax bill is £1,000 or less

What happens if your tax bill decreases year on year?

If you earn a lot of income one year and it drops considerably the next year, it can rightly cause you some concern – because you will potentially have to make a large payment in a year where your income has fallen. So, if you recognise that your next tax bill will be lower than the previous year, it can help to ask HMRC to reduce Payments on Account.

This needs careful consideration, though, because if you end up underpaying, HMRC will charge you interest and could apply penalties. On the other hand, HMRC will refund any overpayments.

How to pay

You can make your tax payments via:

- Online banking

- Telephone banking

- CHAPS or BACS

- Direct debit card online

- At your bank or building society

- At the post office

It can take 3 working days to process a payment via BACS, direct debit and cheque (upon receipt). If you haven’t set up a direct debit arrangement, the first payment will take 5 working days.

You can access what you owe HMRC through its online services. The portal provides you with the payments you need to make in January and July. It also gives you access to historical payments on account.

Top tax tips

Tax can be complicated, but here are some golden rules to help you avoid any issues:

1. Put money aside regularly or find an advisor to help you create a tax payment plan.

2. Get your tax return in early – near the deadline there is more pressure on HMRC’s helpline and support.

3. Check the details carefully for errors.

4. Appoint an accountant to do the hard work for you!

For any concerns or support about hour self-assessment tax returns, get in touch. We provide a full range of accountancy services in The Lune Valley including personal tax planning. We’re trusted accountants for sole traders and small businesses of all kinds. Give us a call and we’ll explain how we can help.