Last year, HMRC received more than 130,000 reports of scams and phishing attempts. With fraudsters becoming ever more sophisticated in their attempts to fool us, it’s important to know what to look out for.

We round up the latest advice and examples of phishing and fraud.

Text or WhatsApp messages

The number of fraudulent text messages has increased by more than a third in the past year. HMRC does send texts out in some situations, but never asks you for personal information.

A common approach is to claim you are due a tax refund, supplying a link. HMRC only sends links to information on the gov.uk website or to HMRC website.

Don’t click on any links unless you are certain they are legitimate, and if the link is to a form requesting information, close it down.

If you have subscribed to the UK Government Channel on WhatsApp, you might receive occasional tax-related reminders. These will be single messages and you will not be able to reply. HMRC will not communicate with you for any other reason using WhatsApp.

Send any suspicious messages to HMRC on 60599 (network charges apply).

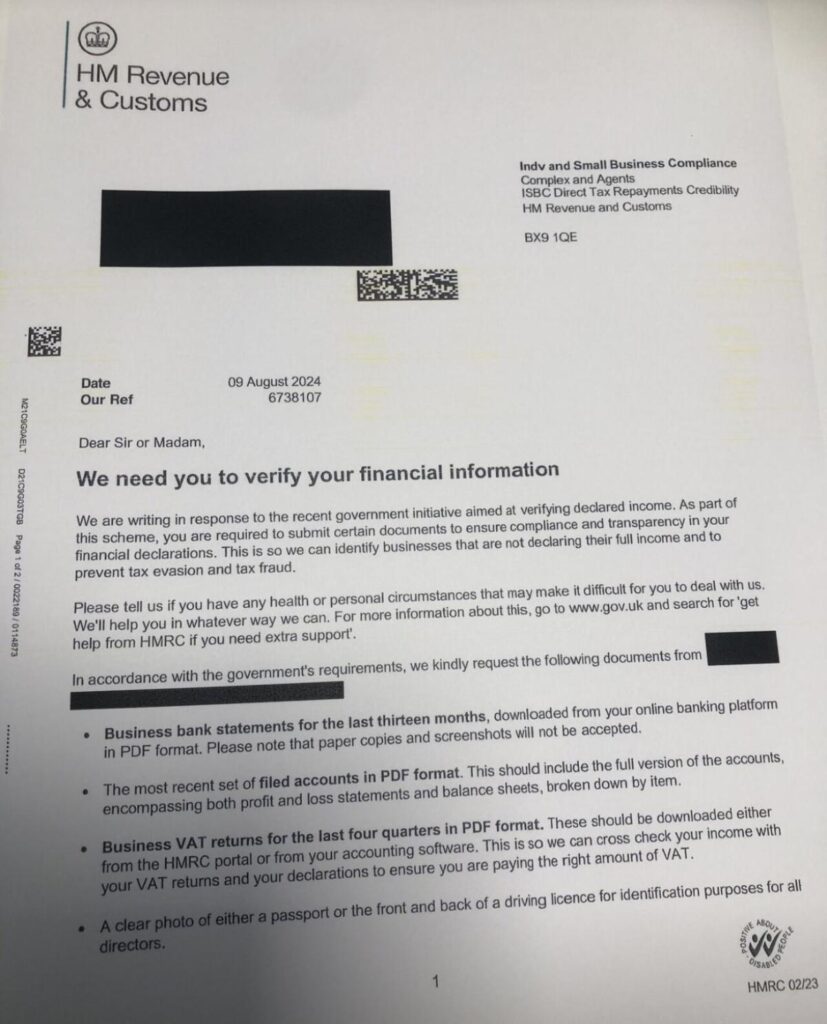

Letters

HMRC recently shared an example of a misleading fraudulent letter that has been in circulation. A copy is below. The letter requests the recipient to email copies of recent bank statements, filed accounts, VAT returns and passport information.

It’s a convincing-looking letter – but one clue is a long and complicated email address. All genuine correspondence from HMRC should end in @hmrc.gov.uk.

QR codes

HMRC does use QR codes in letters and correspondence. The QR code will usually take you to guidance on the GOV.UK website – and if not, the letter will explain the destination for the code.

You will never be taken to a page to input personal information.

Send any suspicious emails or other materials containing QR codes to phishing@hmrc.gov.uk and delete them.

Emails

HMRC will never send notifications by email about tax rebates or refunds.

Don’t click on links in a ‘tax rebate’ email or open any attachments. Never disclose personal or payment information.

Fraudsters are good at making email addresses look genuine – but you can often detect suspicious details by clicking on the sender name. If you are unsure, forward it to HMRC’s phishing address and then delete it.

Phone calls

People are reporting an automated phone call scam that suggest HMRC is filing a lawsuit against you, asking you to press a button to speak to a caseworker and make a payment. You should end a phone call like this immediately.

Other scam calls may refer to National Insurance number fraud, or offer a tax refund, and ask you to provide bank or credit card information.

To help HMRC investigate, share any call details such as the date and phone number used via this online form.

Refund companies

Some companies send emails or texts offering to claim tax refunds or rebates on your behalf, usually for a fee. These companies are not connected with HMRC in any way. You should read the ‘small print’ and disclaimers before using their services.

What to look for

Although online criminals work very hard to make their scams appear real, there can often be a few tell-tale signs that things are not as they seem. Watch out for:

- Spelling errors and untidy formatting

- Email addresses that don’t look genuine

- Any form that requests financial information or personal details

- Strange website addresses that are not part of gov.uk

Helpful rules to follow

The Metropolitan Police suggests following these rules to prevent fraud:

- Be suspicious of all ‘too good to be true’ offers and deals.

- Don’t agree to an offer immediately. Insist on time to get independent or legal advice first.

- Don’t hand over money or sign anything until you’ve checked someone’s credentials and their company.

- Never send money to anyone you don’t know or trust, or use methods of payment you’re not comfortable with.

- Never give banking or personal details to anyone you don’t trust.

- Always log on to a website directly rather than clicking on links in an email.

- If you spot a scam or have been scammed, report it and get help.

What to do if you fall victim to a scam

If you think you’ve fallen victim to fraudsters, contact Action Fraud on 0300 123 2040 or at Action Fraud.

Remember that if you’re a victim of a scam or an attempted scam, however minor, there may be hundreds or thousands of others in a similar position. Your information may be vital in completing the picture.

Don’t be embarrassed – many people fall victim to online crimes each year because fraudsters are experts at deception.

For further advice on tax, tax refunds and staying safe as a taxpayer, we can help. Get in touch with our team today.